Trading Sector

Trade

Main Business Scope

Tianfu Group Trading Division follows the classified supervision business model, and leverages the strong background of Tianfu Group to join hands with Tianfu Bank and other financial strategic partners. It engages in the following business fields: gold trade supply chain and commodity trade supply chain, providing customers in related fields with finance, information, logistics, warehousing, technology, investment, management and operation services.

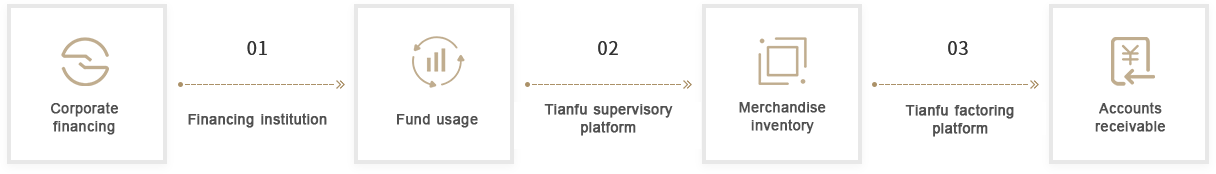

The Trading Division carries out characteristic operation with its two major platforms, i.e., "Tianfu Supervision" platform ("Tianfu E-Commerce (Shanghai) Co., Ltd.") and "Tianfu Factoring" platform ("Shenzhen Qianhai Zixin Jialan Factoring Co., Ltd."). The Division provides enterprise customers with industry-wide supply chain management services in the forms of warehousing, logistics, cargo pledge supervision, and accounts receivable management services, and builds the operation model of "brand + platform + management" and the mature supply chain Tianfu supply chain financial classification supervision business model of "bank financing + goods supervision + receivable management", thereby providing service guarantee for the supply chain business development of Chinese banks and enterprises.

By providing transaction structure analysis and construction services to the upstream and downstream enterprises of the industrial chain, the Division takes Tianfu Group's own financial technology as the starting point to introduce the whole-process trade risk control methods such as contract management, capital control, logistics management, warehousing supervision and accounts receivable management. Closed-loop supervision is provided for different nodes of trade chain transactions to serve cooperative enterprises. Therefore, it can help enterprises to realize the "Three-in-one” integration of information flow, capital flow and logistics and realize the real controllability of supply chain financial risks, so as to truly solve the pain points and difficult problems of supply chain finance and boost the development of supply chain finance business.

Products And Services

Financial product design and system consulting

Tianfu Group Trading Division pools together a group of high-quality talents in the field of finance, who have more than 10 years of working experience in the fields of supply chain, financial market and investment banking. They are familiar with relevant industries, providing enterprise customers with supply chain product policies and industry consulting services.

Industry consulting and transaction structure design

Members of the team are capable of tailoring the transaction structure of supply chain finance to customers as per their industry and transaction characteristics, so as to achieve the closed operation and risk control of industrial supply chain and financial supply chain, and help customers to achieve accurate and effective financial resource docking requirements.

Business intelligence analysis output

The Trading Division of the Group boasts a strong intelligence center team. Through strict layer-by-layer screening and omni-directional monitoring by professional risk control personnel, the team has currently established more than 500 standing high-quality basic customer databases and 100 core enterprise databases in Sichuan Province, which can provide strong customer output support for financial institutions.

Service

Financial Warehousing Supervision

Automobile Integrated Management Platform

Factoring Platform

With Tianfu E-Commerce (Shanghai) Co., Ltd. (to be renamed as "Tianfu Financial Warehousing Supervision Co., Ltd.") as the main service platform, Tianfu Financial Warehousing Supervision Platform focuses on the provision of financial supervision services and controls key nodes through logistics warehousing operation, committed to providing professional, efficient and comprehensive financial warehousing supervision services for financial institutions and various enterprises with professional management model, detailed service concept and scientific project development, and opening up new and convenient channels for SMEs to revitalize their own movable property and obtain low-cost financing.

Integration of supply chain warehousing/logistics/finance and other resources, with warehousing and logistics bases in Sichuan, Guizhou and Shanghai, and varieties covering coal, oil and gas chemical products, household appliances, ferrous metals, non-ferrous metals, edible oil, commodity agricultural products and parallel imported vehicles.

Business handling from the storage of goods to preparation of standard warehouse receipts, covering gold, aluminum, zinc and other delivery varieties.

One-stop import logistics, import customs, import financing and other solutions.

Fully covering the key logistics and warehousing physical nodes, and taking the lead in the industry to use advanced technology such as sap information management system to ensure the safety and efficiency of logistics services.

Services of total quantity/case-by-case control and supervision of pledged goods, with subject matter including: coal, oil and gas chemical products, household appliances, ferrous metals, non-ferrous metals, edible oil, commodity agricultural products, parallel imported vehicles, etc.

Professional mark-to-market service, profit guarantee for financing customers, strict control of the red line of pledge rate for banks, and effective risk control.

Focusing on the automobile industry chain and business chain, Tianfu Automobile Integrated Management Platform provides process solutions centering on auto finance business through scene data management. This platform consists of two major systems that cover the whole process before, during and after loan: Tianfu Automobile Customer Service Platform promotes application before loan of financial institutions (banks, financial leasing companies), auto finance business partner access and online lifecycle management; Tianfu Automobile Asset Management Platform enables continuous tracking and monitoring of automobile assets after loan.

Tianfu Automobile Customer Service Platform aims to boost the high efficiency of banks’batch credit for auto finance business, with the automobile industry chain and business chain as the core; it also provides a business process management platform for automobile rental companies and automobile dealers, etc., offering such core functions as customer information management, and business process management. This platform enhances business efficiency and enables online data-based business.

Tianfu Automotive Asset Management Platform serves financial institutions and auto finance business institutions, targeting the risk management of auto financial assets. This platform comprises auto positioning monitoring, auto asset management and hardware specially designed for the auto finance industry, which enables real-time control of auto finance assets and provides banks and channel partners with intelligent risk control solutions for auto finance.

With Shenzhen Qianhai Zixin Jialan Factoring Co., Ltd. as the main service platform, Tianfu Factoring Platform focuses on the development of service-oriented factoring business based on specific industry supply chain. The platform is dedicated to becoming a factoring company specializing in supply chain financial technology services, with focus on high-quality industries such as construction industry, electronic information, equipment manufacturing, automobile manufacturing, vanadium titanium rare earth, liquor, and bioengineering. The platform makes comprehensive use of big data, blockchain, cloud computing, artificial intelligence and other financial technologies to reconstruct supply chain financial business processes, enhance the supply chain risk prevention and control capabilities of financial institutions and enterprises, and realize further upgrading and optimization of customers and financing structures.

The platform provides factoring financing for customers (sellers), while assuming the buyer's credit risk. In case of credit risk, it will underwrite payment to the seller within the approved underwriting limit, and deduct the corresponding factoring financing principal and interest.

The platform manages the accounts receivable, reconciles the accounts as the sole creditor with the debtor and provides collection services.

The platform provides factoring financing for the seller (without assuming the buyer's credit risk). In case of the buyer's credit risk, the factor has the right to recover from the seller the principal and interest of the factoring financing provided.

The platform assumes the buyer's credit risk, gives the buyer a factoring line, and underwrites payment to the seller within the underwriting limit approved by the factor.

SuccessCase

© SINCE 2020 TIANFU GROUP, ALL RIGHTS RESERVED. 沪ICP备16033206号-1 Powered by Yongsy